Okay, so check this out—staking rewards have become this huge deal in the Solana ecosystem, and honestly, it’s not just hype. At first, I thought staking was just some passive way to earn a few extra tokens, but after diving deeper, I realized it’s a whole game-changer for managing your crypto assets. Really? Yeah, because the way DeFi protocols layer on top of staking complicates your portfolio tracking more than you’d expect.

It’s like you’re juggling while riding a unicycle. You have your staked SOL earning rewards, then you’re interacting with various DeFi protocols that multiply or wrap those assets, and suddenly your portfolio isn’t just a simple list anymore—it’s a living ecosystem. My gut said there had to be a better way to keep tabs on everything without pulling my hair out.

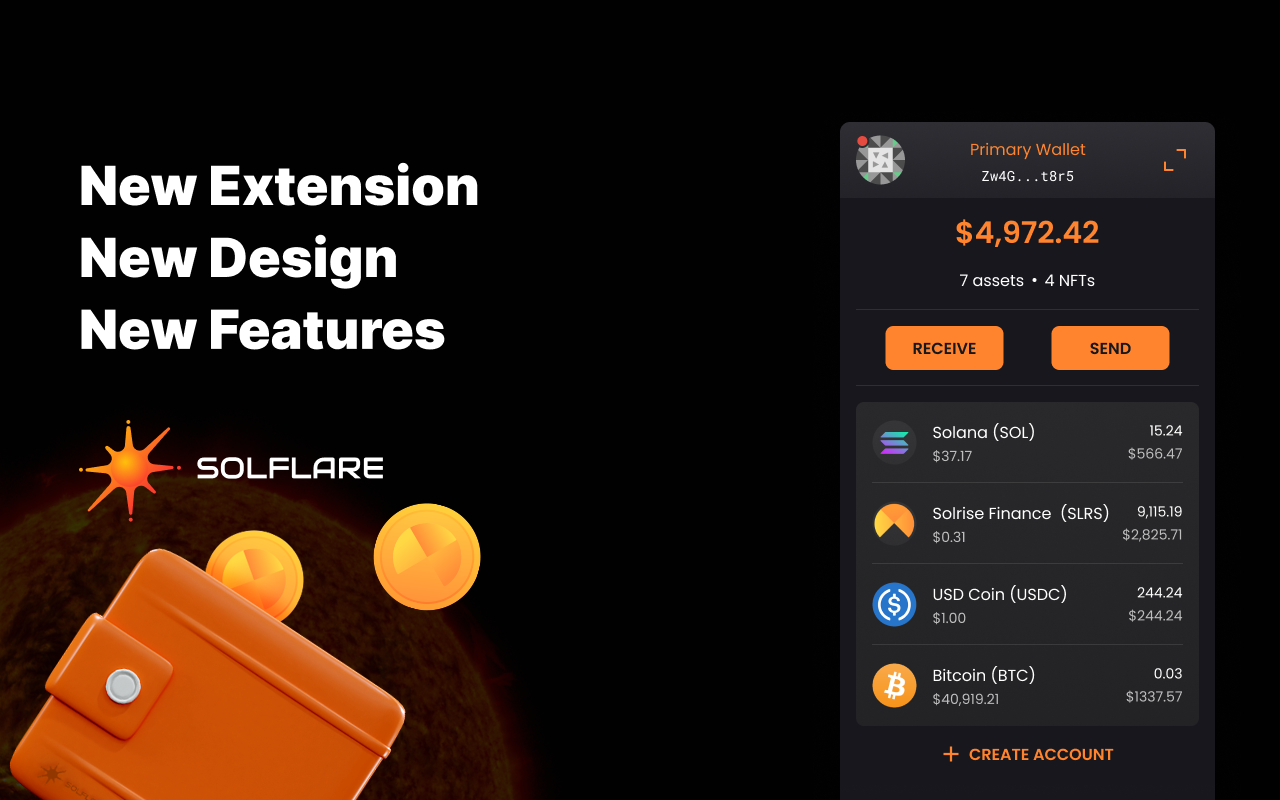

Here’s the thing. Many folks in the Solana space overlook how crucial it is to use a wallet that seamlessly integrates staking and DeFi features. I stumbled onto the solflare wallet extension, and man, it was like a breath of fresh air. The interface makes it surprisingly easy to stake SOL and dive into DeFi protocols without constantly switching apps or losing track of rewards.

But let me throw a wrench in the works. While the rewards look appealing, I noticed the returns can be pretty volatile depending on the protocol’s health and network congestion. On one hand, you’re earning passive income, though actually, some DeFi projects have hidden fees or lock-up periods that aren’t super obvious at first glance. It’s tempting to jump in headfirst, but patience pays off.

Whoa! Imagine staking SOL and simultaneously using DeFi to lend or borrow assets while your wallet tracks all those moving parts. That’s some next-level portfolio management. But managing it without the right tools? Honestly, it can feel like herding cats.

Speaking of tools, I can’t emphasize enough how much easier the whole process becomes with wallets designed specifically for Solana’s ecosystem. The solflare wallet extension, for instance, allows you to visualize your staking rewards accumulating in real-time while interacting with multiple DeFi protocols. This integration saves you from bouncing between interfaces and guessing where your yield is actually coming from.

Let me be real—tracking your crypto portfolio in this space isn’t just about numbers anymore. It’s about understanding the story behind those numbers. Which pools are performing well? Where’s your liquidity locked? What’s the risk exposure on that DeFi contract? The solflare wallet helps with that narrative because it’s built with the user’s experience in mind, not just as a cold spreadsheet of asset balances.

Something felt off about earlier wallets I tried. They were clunky or lacked transparency on staking rewards, which made me miss out on optimizing my returns. Plus, some wallets don’t support staking and DeFi together, forcing you into multiple accounts. That’s a hassle I don’t wanna deal with.

Here’s a little secret: many users don’t realize how important portfolio tracking is until they try to claim rewards or rebalance their positions and get confused. Oh, and by the way, some DeFi protocols distribute rewards in different tokens, so your portfolio becomes a patchwork quilt of assets. Tracking that without a unified view is nearly impossible.

DeFi Protocols and Staking: A Double-Edged Sword?

Initially, I thought staking was a set-it-and-forget-it deal. But then DeFi stepped in, and things got complicated. There’s a lot of excitement around yield farming and liquidity pools, but also more risk. You can earn double or triple rewards by staking in certain protocols, but the complexity can make your portfolio look like a jigsaw puzzle missing pieces.

For example, some DeFi platforms on Solana offer synthetic assets or wrapped tokens representing your staked SOL, which you can use as collateral elsewhere. That’s powerful, yes, but tracking these derivatives alongside your base assets is tricky. Your portfolio might show staked SOL, wrapped SOL derivatives, and liquidity pool tokens all at once. Without the right tools, it’s easy to lose track or double-count your holdings.

Hmm… this kind of layering makes me wonder if the average user really understands their exposure. Are we just chasing rewards blindly? Or is there a smarter way to navigate this? My instinct says the latter, but it requires better portfolio transparency and education.

It’s also worth mentioning that DeFi protocols vary wildly in security and reliability. Some promising projects have tanked due to bugs or exploits, wiping out staked assets and rewards. That’s why I’m biased toward wallets and platforms that emphasize security and user control, like the solflare wallet, which gives you direct management of your keys and staking delegation.

Really, the whole staking + DeFi combo is a bit of a double-edged sword. On one hand, you can maximize your returns and participate in cutting-edge finance. On the other, it demands more vigilance and smarter tracking—or you risk losing your edge (or worse, your funds).

Portfolio Tracking: The Unsung Hero of Crypto Success

Tracking your portfolio isn’t just about watching numbers tick up. It’s about making informed decisions based on those numbers. I’m not 100% sure, but I think many users underestimate how much better they’d do if they had a clear, real-time picture of their staking rewards and DeFi positions combined.

One feature I really appreciate in the solflare wallet is how it consolidates all your asset info into one dashboard. You see your SOL staked, rewards pending, liquidity pool shares, and even your history of transactions—all in one place. That’s huge for staying on top without mental overload.

Plus, the wallet’s design feels intuitive, which matters because crypto can get overwhelming fast. I’ve seen some portfolio trackers that are so technical, they might as well be coded in Klingon. Not here. This wallet strikes a good balance between depth and accessibility.

Here’s what bugs me about traditional crypto portfolio trackers—they often miss the nuances of staking and DeFi rewards, especially when rewards come in different tokens or when there are lock-up periods. You end up guessing your real yield or forgetting to claim rewards, which is money left on the table.

Wow! When you combine a smart wallet with good portfolio tracking, you’re basically giving yourself superpowers. You can rebalance faster, avoid unnecessary fees, and spot opportunities before they go mainstream.

Honestly, staking rewards and DeFi are reshaping how we think about crypto portfolios. It’s no longer just buy-and-hold. It’s active, layered, and dynamic. And the right tools, like the solflare wallet, are essential to navigate that complexity without losing your mind or your funds.

Frequently Asked Questions

What makes staking rewards on Solana different from other blockchains?

Solana’s high throughput and low fees mean staking rewards can be more accessible and frequent. Plus, the ecosystem’s growth has led to many integrated DeFi protocols that layer additional yield opportunities on top of staking.

How does DeFi complicate portfolio tracking?

DeFi protocols often introduce wrapped tokens, liquidity pool shares, and synthetic assets that represent your staked holdings. This layering can obscure your true asset exposure unless you use a wallet or tracker that consolidates this information.

Why choose the solflare wallet for staking and DeFi?

The solflare wallet extension supports both staking and DeFi interactions natively, offering real-time portfolio tracking, user-friendly interfaces, and strong security features that keep your assets under your control.

More partner links from our advertiser:

- Cross-chain bridge with fast routing and clear fee tracking — https://sites.google.com/mywalletcryptous.com/relay-bridge-official-site/ — move assets smoothly between networks.

- Bitcoin wallet focused on Ordinals & BRC-20 — https://sites.google.com/walletcryptoextension.com/unisat-wallet/ — mint, manage, and browse inscriptions in-browser.

- Lightweight, time-tested BTC client — https://sites.google.com/walletcryptoextension.com/electrum-wallet/ — quick setup with hardware support and advanced tools.

- Liquid staking made simple — https://sites.google.com/cryptowalletuk.com/lido-official-site/ — understand yields, risks, and how staked tokens work.